Source How to Pay Less Dividend Withholding Tax. Hence if you wish to.

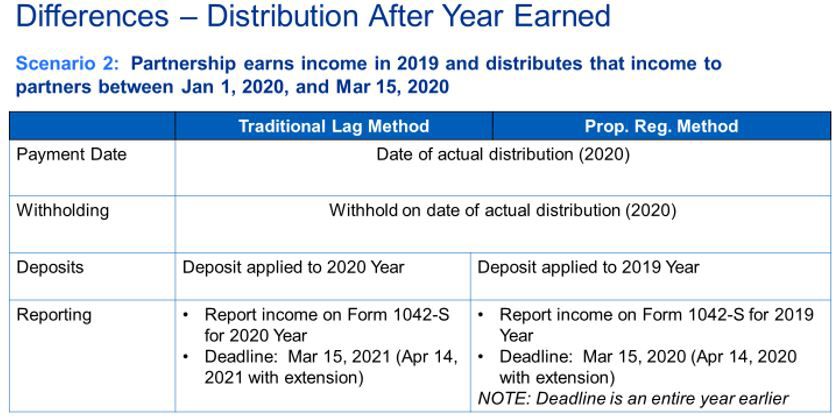

Kpmg Report Reminder About Partnership Reporting Kpmg United States

Pensions annuities management fees interest dividends rents royalties estate or trust income and payments for film or video acting services when you pay or credit these amounts to individuals including trusts or corporations that are not resident in.

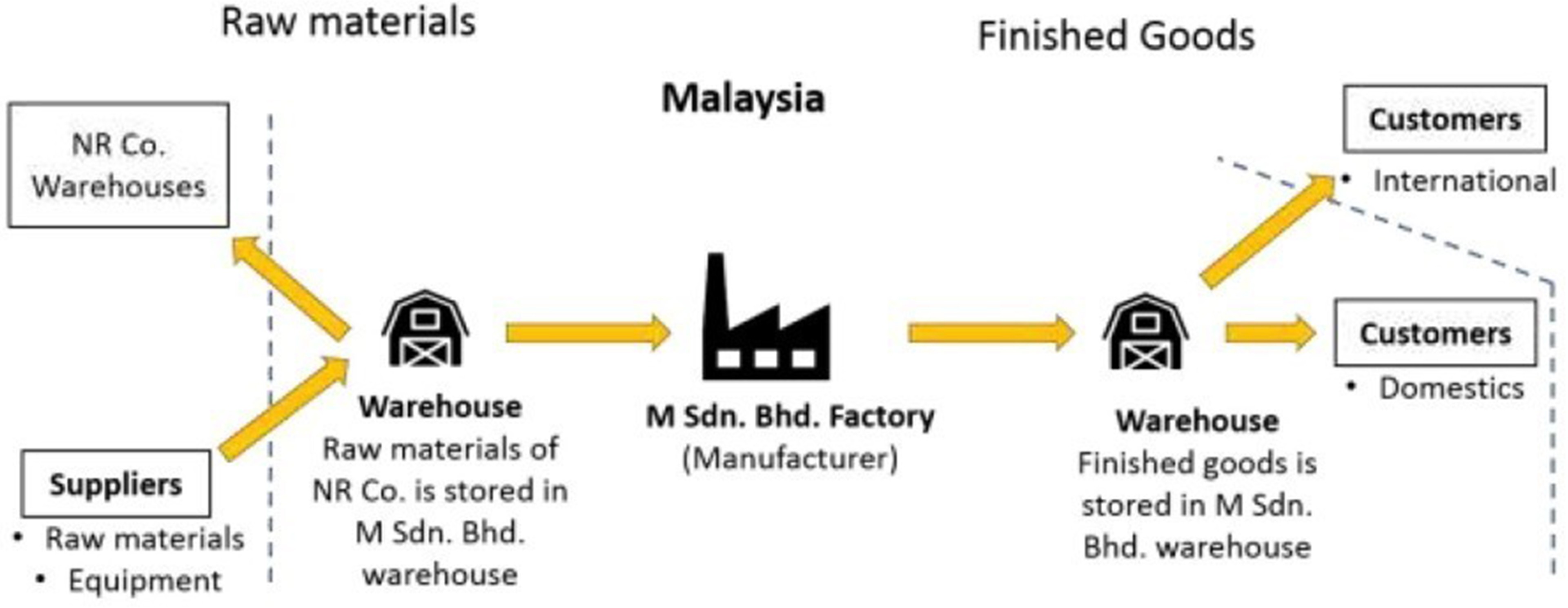

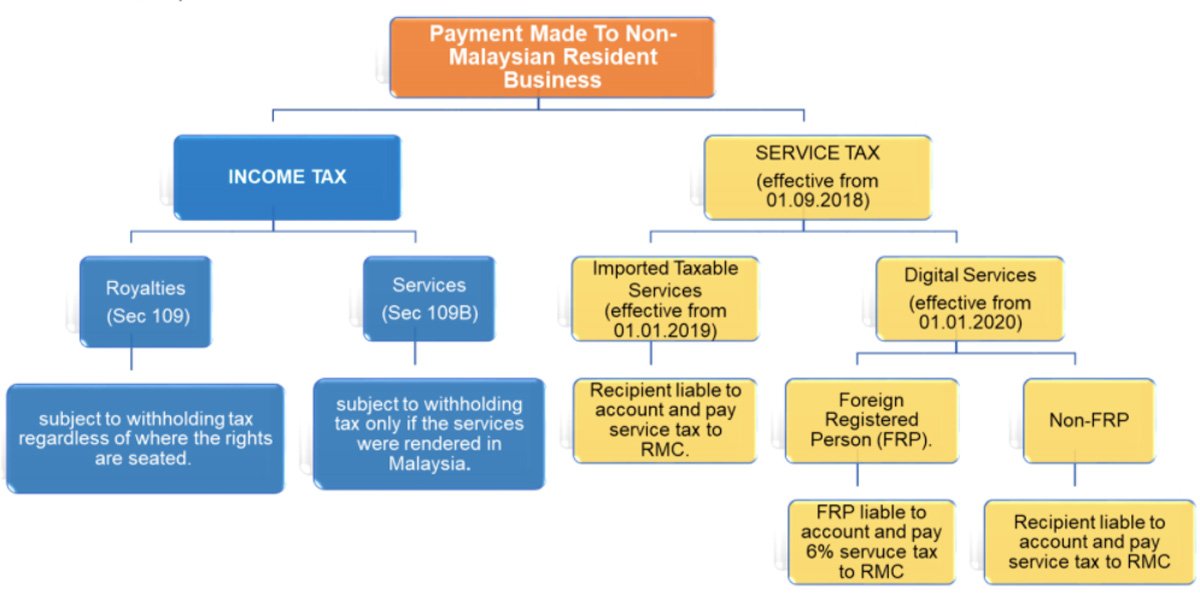

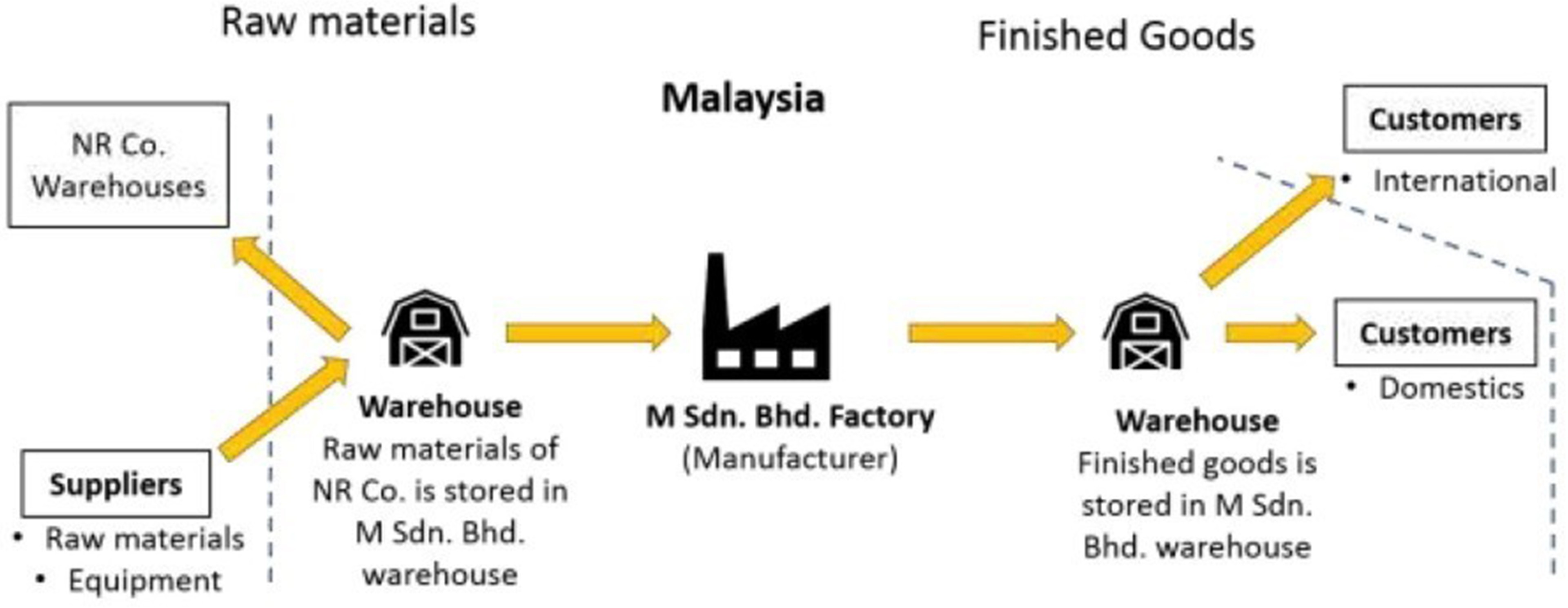

. 1 Avoid dividend stocks listed in the US. However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying.

The Accounting for income tax video also explains the circumstances in which tax must be withheld on certain payments and. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. Withholding tax on payments of interest.

This guidance note explains the main scenarios where UK companies other than financial institutions etc must withhold tax at source on payments of interest and how this is dealt with in practice. Withholding tax is an amount of tax that is being withheld by the payer on the income earned by a non-resident payee. Order 92 Rule 4 of the Rules of Court 2012.

If a stock doesnt pay out dividends you are not subjected to the Dividend Withholding Tax. Argentina Last reviewed 17 February 2022. Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967.

Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie. Interest on loans granted by third parties or shareholders is liable to investment income tax at 15 and 10 respectively. Part XIII tax is a withholding tax imposed on certain amounts you pay or credit to non-residents.

There are four ways you can reduce the amount of withholding tax on your dividends. Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting. This deduction of tax at source does not represent a final tax which is determined upon the filing of the tax return.

Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957.

Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24. Government of Malaysia V MNMN. Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting.

Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax. The amount of tax is paid to the Inland Revenue Board of Malaysia IRBM.

Laravel Training In Karachi 3d Educators Technology Systems Information Technology Development

Introduction To Withholding Tax Imported Services Tax Part 1

Tax Research Greater Bay Area Series Deloitte China Financial Services

Guidelines On Determining If A Place Of Business Exists In Malaysia Ey Malaysia

Stock Donations 7 Essentials To Maximize Your Charitable Giving Tax Deduction

Notice Withholding Tax 10 Enagic Malaysia Sdn Bhd

Customizable And Printable Rent Receipt Templates To Help You Save Time When Creating Receipts Receipt Template Free Receipt Template Templates Printable Free

How To Handle Tax Risk An In House Perspective

What Is The Tax Treatment Of College And University Endowments Tax Policy Center

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Payroll Template

Income Tax Poster Psd Template Income Tax Psd Templates Templates

3 21 111 Chapter Three And Chapter Four Withholding Returns Internal Revenue Service

Teacup Pomeranian Puppies For Sale In Malaysia Teacup Pomeranian Puppies For Sale In Banga In 2022 Pomeranian Puppy Pomeranian Puppy Teacup Pomeranian Puppy For Sale

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Payroll Template

Introduction To Withholding Tax Imported Services Tax Part 3